Stainless Steel Coil International Trading Companies: A Complete Guide

Navigating the complex global market for stainless steel coils can be daunting. Missteps lead to supply chain disruptions[^1] and cost overruns, impacting your projects. This guide provides the clarity you need.

A complete guide to stainless steel coil trading companies involves understanding the global market, current trends, and key challenges. It requires strategic partnerships with integrated suppliers like MFY who leverage technology to ensure reliable delivery, consistent quality, and competitive pricing for your projects.

As the Global Business Director at MFY, I've spent years on the front lines of the stainless steel industry. I've seen firsthand how a well-managed supply chain can be a powerful competitive advantage. The world of international trade is complex, but it doesn't have to be overwhelming. The key is to partner with a company that not only understands the product but also the intricate dance of global logistics, market dynamics, and emerging technologies. In this guide, I'll share my perspective on what it takes to succeed, breaking down the essential elements you need to know to make informed decisions for your business.

What Defines the Global Stainless Steel Coil Market?

The market seems vast and intimidating. Without a clear overview, you can't spot the right opportunities or partners. Let's break down the key players and demand drivers together.

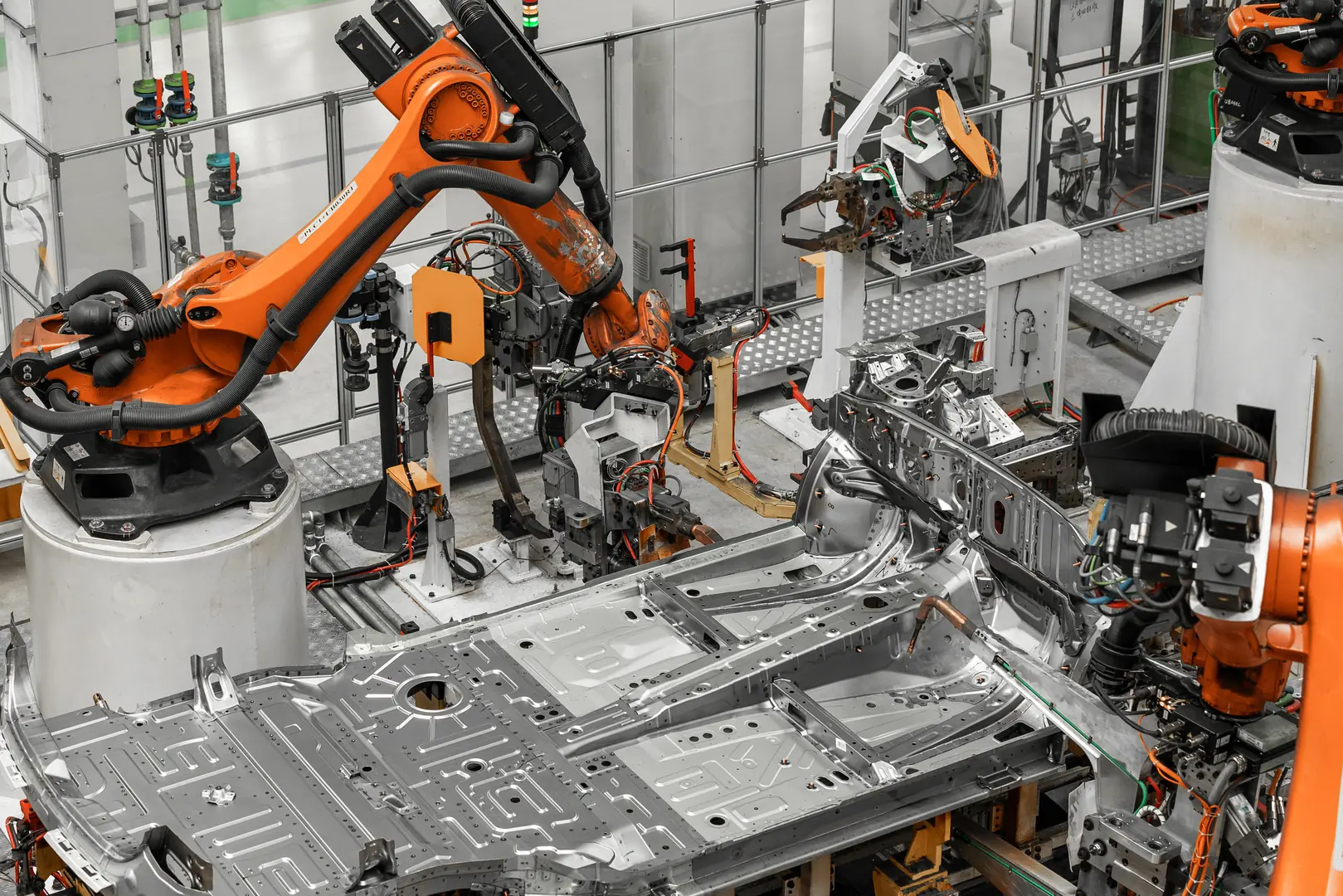

The global stainless steel coil market is a dynamic ecosystem driven by major producing nations and increasing demand from sectors like construction, automotive, and manufacturing. Its health is a key indicator of industrial growth worldwide.

To truly understand international trading, we must first look at the big picture. The market isn't just about buying and selling; it's about the flow of materials that builds our modern world. From the skyscrapers that define our cities to the vehicles that connect them, stainless steel is the backbone of progress. At MFY, we see this every day. The demand is fueled by powerful global forces like rapid urbanization in developing nations and continuous technological advancements that require higher-performance materials. I remember a project with a client in Southeast Asia who was building a massive new public transit system. Their need for high-strength, corrosion-resistant stainless steel[^2] coils was a direct result of this urban growth, and our ability to deliver on time was critical to keeping their project on schedule.

Key Producing Regions

The supply side is concentrated in a few key areas, with China leading production. This concentration creates a unique dynamic where understanding the production capabilities and export policies of these regions is essential for any buyer. An integrated partner can help you navigate this.

| Region | Key Strength | Market Impact |

|---|---|---|

| China | Massive scale, integrated supply chains | Sets global pricing benchmarks |

| Europe | High-quality, specialized grades | Leader in technical innovation |

| India | Rapidly growing production capacity | Emerging as a major global player |

Major Demand Sectors

On the demand side, the applications are incredibly diverse. The automotive industry's shift to electric vehicles, for example, is creating new demand for specific stainless steel grades. Likewise, the global push for resilient infrastructure means more stainless steel is needed for bridges, water treatment plants, and energy facilities. Understanding these sector-specific needs is what allows a trading partner to add real value.

What are the Current Trends in Stainless Steel Coil Trading?

The industry is constantly changing. Falling behind on the latest trends means losing your competitive edge and missing opportunities. Here are the key shifts you need to watch closely.

Current trends include a major shift towards sustainability and "green steel," the digitalization of supply chains for greater transparency, and a growing demand for specialized grades of stainless steel tailored to high-tech applications.

Staying static is not an option in our industry. The most significant trend I see today is the move towards a more sustainable and transparent supply chain. Clients are no longer just asking about price and delivery times; they want to know about the environmental impact of their materials and the ethical standards of their suppliers. This is a positive change, and it's one we at MFY are embracing wholeheartedly. It's not just about compliance; it's about building a more resilient and responsible business for the future. This shift forces us to be more innovative and efficient, which ultimately benefits our customers.

The Rise of Green Steel

Sustainability is now a core business requirement. "Green steel" refers to steel produced using methods that significantly reduce carbon emissions, often involving electric arc furnaces[^3] and renewable energy sources. While the technology is still evolving, the demand is growing exponentially. Companies that can provide transparent data on their carbon footprint and offer lower-carbon options will have a distinct advantage. We are actively working with our production partners to increase the availability of these products in our portfolio.

Supply Chain Digitalization

The days of relying on phone calls and faxes are over. Digitalization is transforming how we manage global trade. From online portals for order tracking to more advanced systems for inventory management, technology is making the supply chain faster, more transparent, and less prone to error. This aligns perfectly with our vision at MFY to be a leader in service and innovation, using digital tools to give our clients a seamless and reliable experience.

What are the Biggest Challenges for International Trading Companies?

International trade is full of hurdles. Geopolitical tensions, volatile prices, and logistical nightmares can derail your projects. Let's identify the main obstacles so we can prepare to overcome them.

The primary challenges include navigating complex geopolitical landscapes, managing volatile raw material prices, and overcoming logistical bottlenecks. Ensuring consistent quality control across vast distances also presents significant difficulty.

If this business were easy, everyone would be doing it. The reality is that we operate in a world of constant uncertainty. I’ve had to reroute entire shipments overnight due to sudden port closures and renegotiate contracts because of unexpected tariffs. These challenges are not exceptions; they are part of the daily fabric of international trade. A few years ago, a major shipping lane blockage caused a ripple effect across the globe. We had several containers of critical material for a European automotive client stuck at sea. Our team worked around the clock, coordinating with logistics partners and keeping the client informed every step of the way. It’s in moments like these that the strength of a trading partner is truly tested. It’s not about avoiding problems—it’s about how you solve them.

Navigating Geopolitical Uncertainty

Trade policies, tariffs, and international relations can change in an instant, directly impacting costs and delivery schedules. A deep understanding of the global political climate is no longer optional; it's essential for risk management.

Managing Price and Supply Volatility

The prices of raw materials like nickel and chromium are notoriously volatile. This makes long-term planning difficult and requires sophisticated hedging strategies and market analysis to protect both our business and our clients from sudden price shocks.

| Challenge | Primary Impact on Buyers |

|---|---|

| Geopolitical Risk | Sudden tariffs, shipping delays, supply disruption |

| Price Volatility | Unpredictable project costs, budget overruns |

| Logistical Bottlenecks | Production halts, missed project deadlines |

| Quality Control | Inconsistent material performance, project failures |

What are the Best Strategies for Overcoming These Trading Challenges?

These challenges can seem overwhelming. Without effective strategies, your business and supply chain are at constant risk. Here’s how leading companies like MFY build resilience and turn challenges into opportunities.

Effective strategies involve building strong, integrated supply chain partnerships, leveraging data analytics for predictive forecasting, and diversifying sourcing and logistics routes. A focus on agility and communication is crucial for navigating uncertainty.

The key to overcoming challenges isn't a single magic bullet; it's a comprehensive strategy built on a foundation of resilience and agility. At MFY, our entire business model is designed around this principle. We didn't just decide to become a trading company; we built a fully integrated supply chain that gives us control and flexibility from raw material sourcing to final delivery. This integration is our most powerful tool against uncertainty. When one shipping route is congested, we have alternatives ready. When one production facility faces a delay, we can shift orders to another. This isn't just a benefit for us; it's a direct assurance to our clients that their supply is secure. It transforms the conversation from "if" we can deliver to "how" we will deliver, no matter the circumstances.

The Power of an Integrated Supply Chain

This is our core strength at MFY. By having deep integration with production and inventory, we reduce our reliance on external parties and can respond much faster to market changes. It allows us to guarantee quality and provide our clients with a single, accountable point of contact. This is the most effective way to ensure supply continuity.

Data-Driven Decision Making

We use market data and analytics to anticipate trends and potential disruptions. By analyzing shipping data, commodity prices, and economic indicators, we can make more informed purchasing and logistics decisions. This proactive approach helps us mitigate risks before they impact our clients' projects, moving from a reactive to a predictive operational model.

What Technological Innovations are Shaping Stainless Steel Coil Trading?

Technology is disrupting every industry. Ignoring these powerful new tools means being left behind by more efficient competitors. Let's explore the tech that is transforming stainless steel trade for the better.

Key technological innovations include AI-powered demand forecasting, IoT for real-time shipment tracking, and blockchain for secure, transparent transactions. These tools are revolutionizing supply chain efficiency, reducing errors, and building trust.

Technology is the great enabler. It's what allows us to translate our strategies into reality on a global scale. For years, the steel industry was seen as traditional and slow to adapt, but that is changing rapidly. We are on the cusp of a technological revolution in trade, and at MFY, we are determined to be at the forefront. The unique perspective we must embrace is the complete digitalization of our trade channels. It’s not just about having a website; it’s about using deep-tech tools like AI and blockchain to build a supply chain that is not only efficient but also fundamentally more trustworthy and transparent. This isn't a far-off dream; we are actively implementing these technologies to solve real-world problems for our clients today.

Blockchain for Unmatched Transparency

Blockchain technology offers the potential for an immutable, shared ledger of every transaction in the supply chain. This means a buyer in Germany can verify the origin, quality certificates, and transit history of a coil from China with absolute certainty. It builds trust and drastically reduces the risk of fraud.

AI and IoT for Predictive Logistics

Imagine knowing exactly where your shipment is, its temperature, and its humidity, all in real-time. That's what the Internet of Things (IoT)[^4] sensors provide. When combined with Artificial Intelligence (AI), we can analyze this data to predict potential delays and optimize routes dynamically, ensuring your materials arrive on time.

| Technology | Core Benefit in Steel Trading |

|---|---|

| Blockchain | Enhanced security, fraud prevention, and traceability |

| Artificial Intelligence (AI) | Predictive demand forecasting and route optimization |

| Internet of Things (IoT) | Real-time shipment tracking and condition monitoring |

Conclusion

Success in stainless steel coil trading hinges on partnering with a forward-thinking supplier. At MFY, we combine an integrated supply chain with technological innovation to deliver the reliability, quality, and agility your business needs to thrive in a complex global market.

Have Questions or Need More Information?

Get in touch with us for personalized assistance and expert advice.