The global stainless steel market is booming, with China at its epicenter. As a buyer, you're likely eyeing the attractive prices and vast selection. But beware! The path to successful procurement is riddled with potential pitfalls that could cost you dearly.

Navigating the Chinese stainless steel market1 requires careful consideration of quality control, supplier reliability, and regulatory compliance. Buyers must be vigilant about material specifications, pricing fluctuations, and potential communication barriers to ensure successful transactions.

I've been in the stainless steel industry for over two decades, and I've seen countless buyers stumble into avoidable traps. But don't worry - with the right knowledge and strategies, you can sidestep these pitfalls and secure high-quality stainless steel at competitive prices. Let me guide you through the intricacies of sourcing from China.

The Chinese stainless steel market is a double-edged sword. On one side, it offers unparalleled opportunities with its vast production capacity and competitive pricing. On the other, it presents unique challenges that can catch even seasoned buyers off guard. The key to success lies in understanding both the opportunities and the risks. Let's dive deeper into this complex landscape and explore how you can navigate it successfully.

What is the background of the stainless steel market in China?

China's stainless steel industry has undergone a remarkable transformation over the past few decades. I remember when it was just a fledgling sector, struggling to meet domestic demand. Now, it's a global powerhouse, dominating international markets with its sheer volume and competitive pricing.

China's stainless steel market has grown exponentially, becoming the world's largest producer and consumer. The industry's rapid expansion, driven by government support and technological advancements, has positioned China as a key player in the global stainless steel trade2.

This meteoric rise didn't happen overnight. It's the result of strategic planning, massive investments in infrastructure, and a relentless drive for technological advancement. I've witnessed firsthand how Chinese manufacturers have evolved, adopting cutting-edge production techniques and expanding their product ranges to meet diverse global demands.

The Rise of China's Stainless Steel Industry

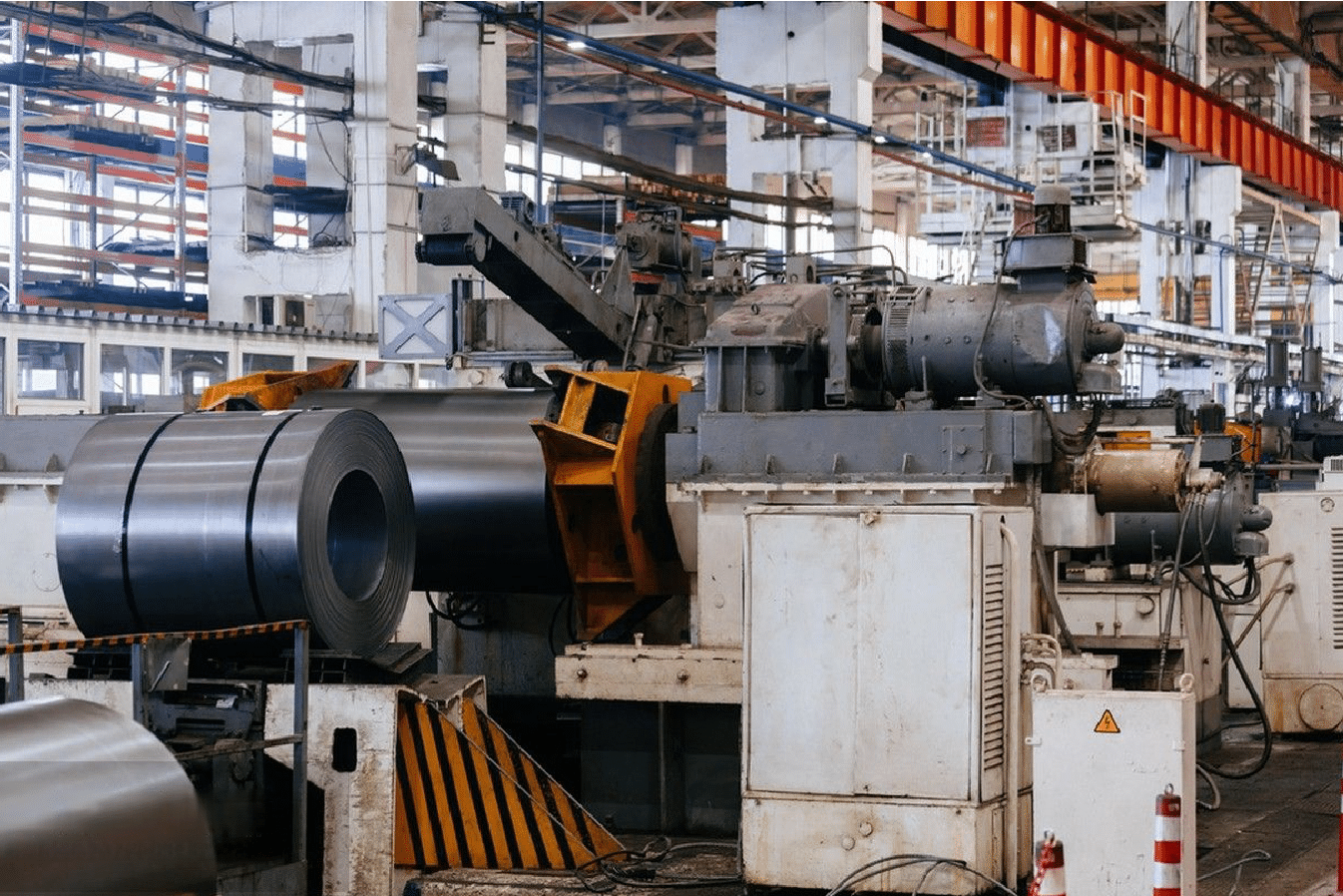

China's journey to becoming a stainless steel powerhouse began in the late 1990s. At that time, the country was primarily focused on meeting its domestic demand, which was growing rapidly due to urbanization and industrialization. I remember visiting Chinese steel mills during this period - they were a far cry from the state-of-the-art facilities we see today.

The turning point came in the early 2000s when the Chinese government recognized the strategic importance of the steel industry. They implemented a series of policies aimed at boosting production capacity and improving quality. This included substantial investments in new technologies, mergers and acquisitions to create larger, more efficient companies, and incentives for research and development.

One of the key factors that contributed to China's success3 was its ability to secure a stable supply of raw materials. The country invested heavily in mining operations both domestically and abroad, ensuring a steady flow of nickel, chromium, and other essential elements for stainless steel production. This vertical integration gave Chinese producers a significant cost advantage over their international competitors.

Technological Advancements and Quality Improvements

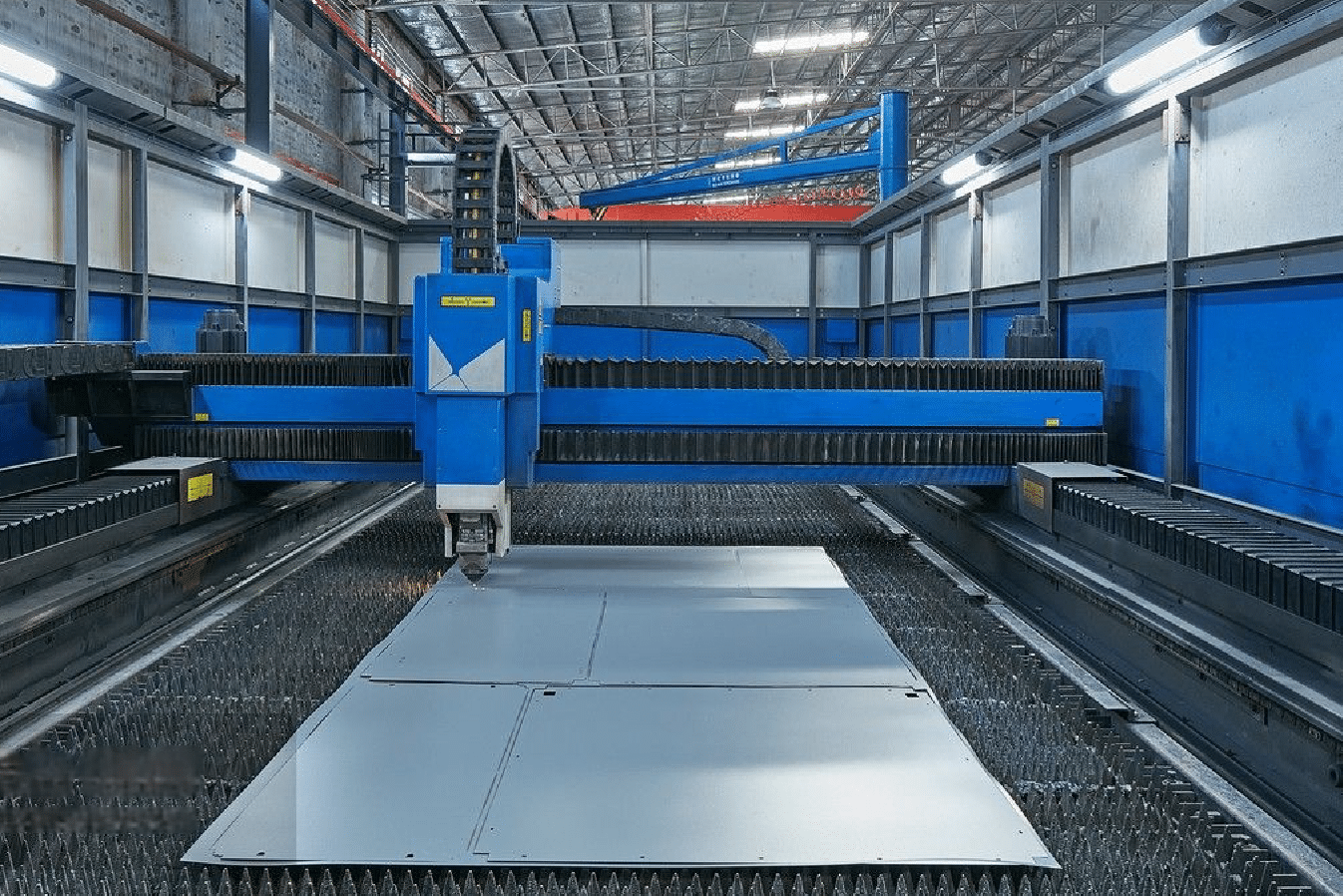

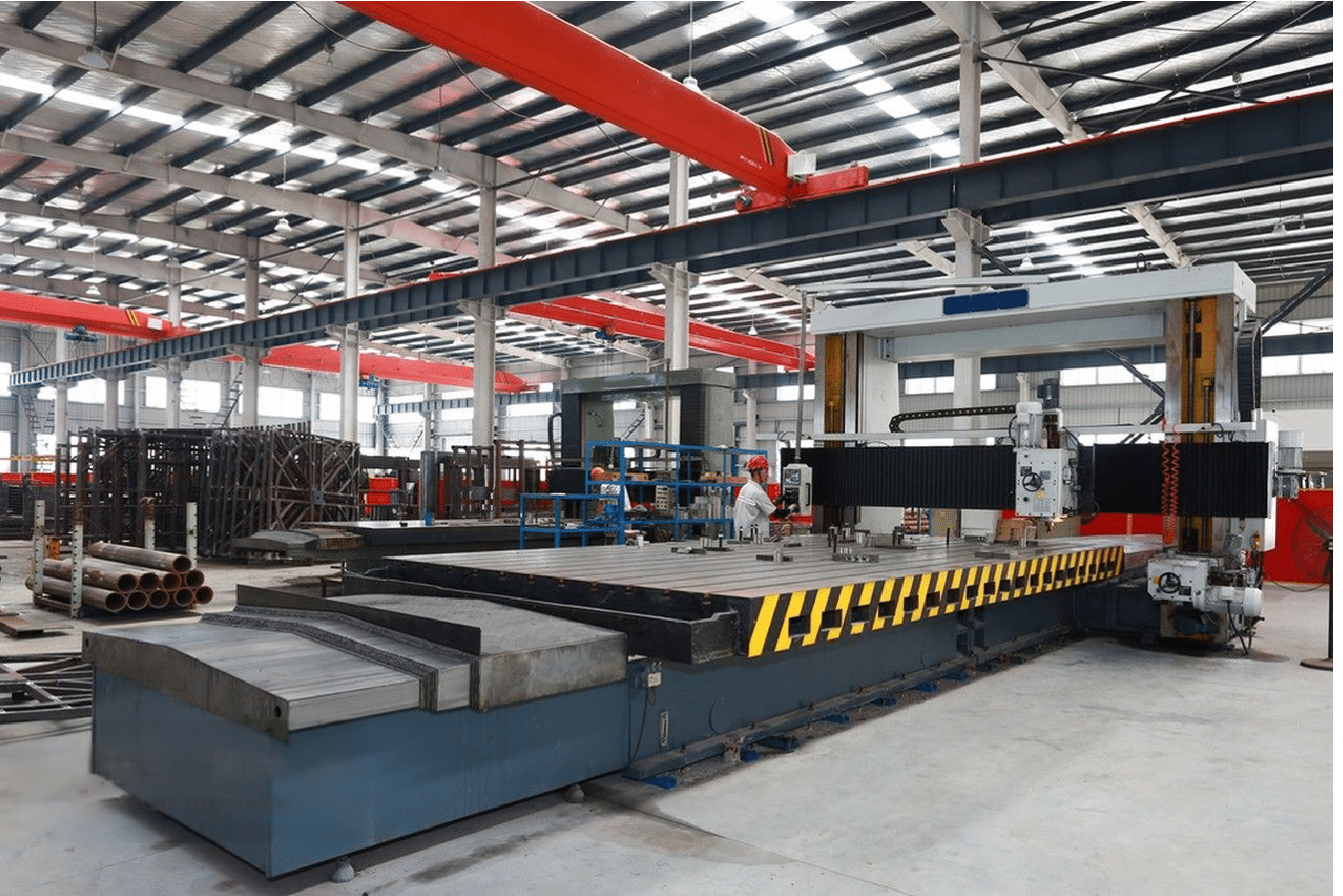

As China's stainless steel industry grew, so did its technological capabilities. I've had the opportunity to tour several Chinese steel mills over the years, and the transformation has been nothing short of remarkable. Modern Chinese steel mills now boast some of the most advanced equipment in the world, including state-of-the-art electric arc furnaces, AOD (Argon Oxygen Decarburization) converters, and continuous casting machines.

These technological advancements have not only increased production efficiency but also significantly improved the quality of Chinese stainless steel. In the early days, Chinese stainless steel often had a reputation for inconsistent quality. However, through rigorous quality control measures and investments in testing equipment, many Chinese manufacturers now produce stainless steel that meets or exceeds international standards4.

Market Dominance and Global Impact

By the mid-2010s, China had firmly established itself as the world's largest producer and consumer of stainless steel. According to data from the International Stainless Steel Forum (ISSF), China's share of global stainless steel production grew from about 3% in 2000 to over 50% by 2020. This dramatic increase has had far-reaching effects on the global stainless steel market.

| Year | China's Share of Global Stainless Steel Production |

|---|---|

| 2000 | ~3% |

| 2010 | ~36% |

| 2020 | >50% |

China's dominance has led to significant changes in global trade patterns. Many traditional stainless steel producing countries have seen their market shares erode as Chinese exports flooded the market. This has led to trade tensions and anti-dumping measures in some regions, adding another layer of complexity for international buyers.

Despite these challenges, China's stainless steel industry continues to evolve. In recent years, there has been a growing focus on sustainability and environmental protection. Many Chinese steel mills are investing in cleaner production technologies and exploring ways to reduce their carbon footprint. This shift towards greener production methods is likely to shape the future of China's stainless steel industry and its position in the global market.

China dominates stainless steel productionTrue

China's share of global stainless steel production exceeded 50% by 2020, making it the world's largest producer.

China's steel quality was always highFalse

In the early days, Chinese stainless steel often had a reputation for inconsistent quality, but it has significantly improved over time.

What is the current situation for international buyers sourcing stainless steel from China?

As an international buyer, sourcing stainless steel from China can feel like navigating a complex maze. I've been in your shoes, and I understand the mix of excitement and apprehension that comes with tapping into this vast market.

The current landscape for international buyers sourcing stainless steel from China is characterized by abundant opportunities5 alongside significant challenges. While competitive pricing and diverse product offerings are attractive, buyers must navigate quality inconsistencies, regulatory hurdles, and market volatility.

The situation is dynamic, with new opportunities and challenges emerging constantly. On one hand, China offers an unparalleled range of products at competitive prices. On the other, you're faced with a myriad of suppliers, varying quality standards, and potential communication barriers. Let's delve deeper into this complex landscape.

Opportunities in the Chinese Stainless Steel Market

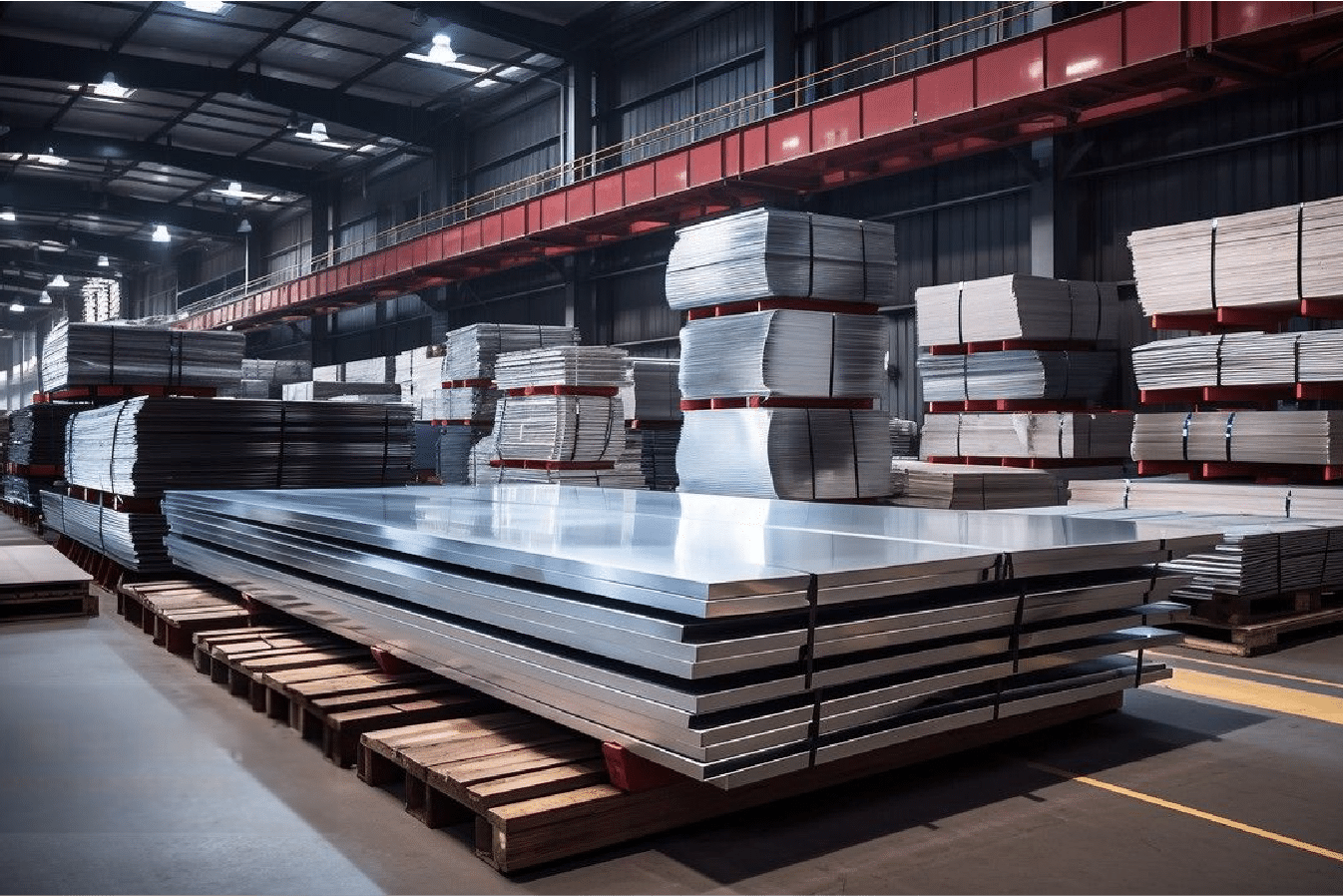

The sheer scale of China's stainless steel industry presents numerous opportunities for international buyers. With thousands of manufacturers and suppliers, you have access to a vast array of products, grades, and specifications. This diversity allows you to find exactly what you need, often at prices that are hard to match elsewhere.

I remember when I first started sourcing from China. The variety was overwhelming, but it also meant that I could find specialized products that weren't readily available in other markets. For instance, when I needed a specific grade of duplex stainless steel for a client's marine application, I found a Chinese supplier who not only had the product in stock but could also offer it at a competitive price.

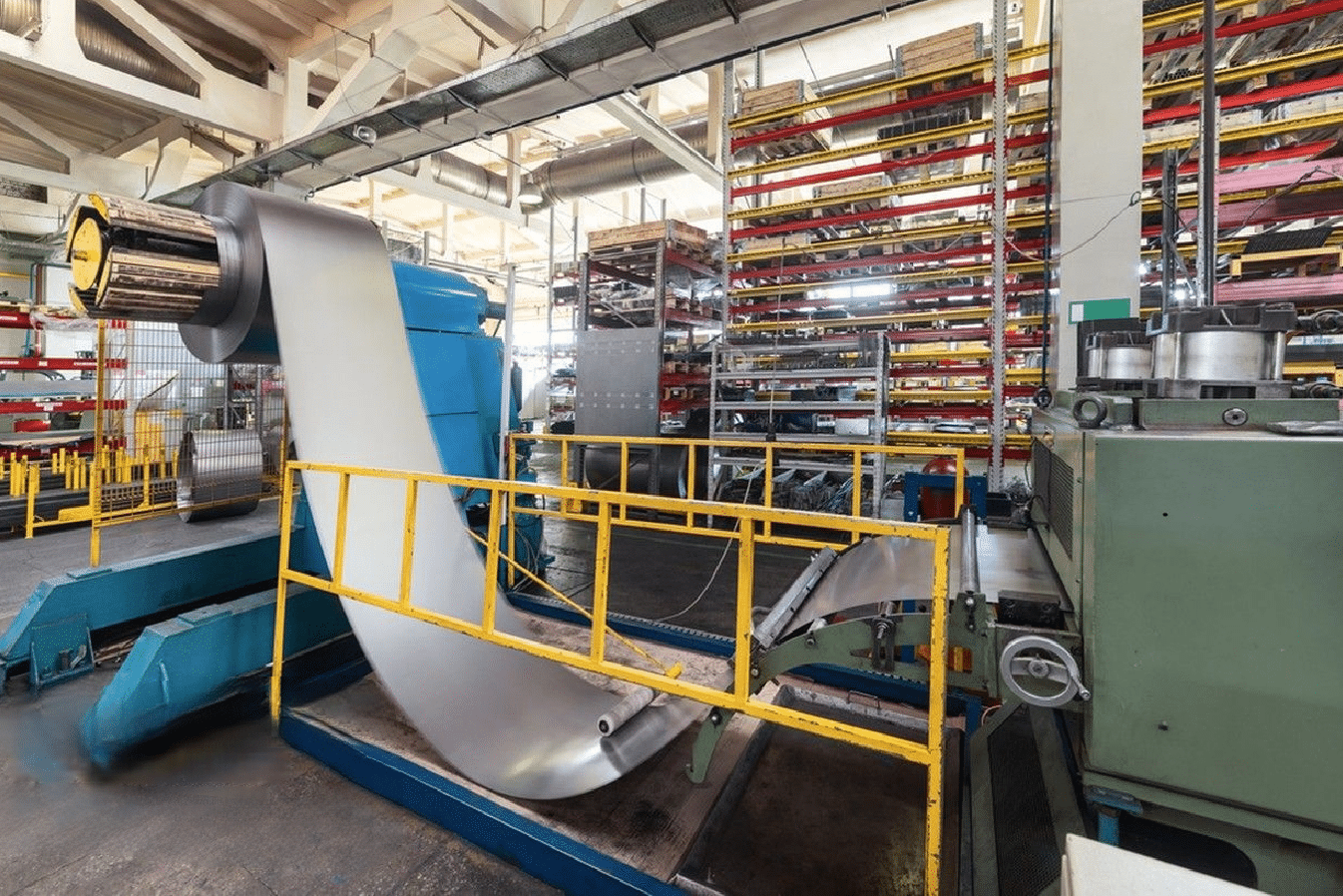

Another significant advantage is China's well-developed supply chain. Many stainless steel manufacturers are clustered in industrial zones, creating ecosystems that include raw material suppliers, processors, and logistics providers. This integration often translates to faster production times and more flexible order quantities.

Challenges in Quality Control and Consistency

While the opportunities are abundant, so are the challenges. Quality control remains a significant concern for many international buyers. In my experience, the quality of Chinese stainless steel can vary widely between suppliers and even between batches from the same supplier.

One particularly memorable incident occurred when I received a shipment of 304 stainless steel sheets that didn't meet the specified corrosion resistance standards. It turned out that the manufacturer had cut corners by using lower-grade raw materials. This experience taught me the importance of rigorous quality control measures and third-party inspections.

To address these challenges, many reputable Chinese manufacturers have implemented stringent quality management systems and obtained international certifications like ISO 9001. However, as a buyer, you still need to be vigilant and proactive in ensuring that the products you receive meet your specifications.

Navigating Regulatory and Trade Complexities

The regulatory landscape for stainless steel imports from China is complex and ever-changing. Trade tensions between China and various countries have led to the implementation of tariffs and anti-dumping duties on certain stainless steel products. These measures can significantly impact the cost-effectiveness of sourcing from China.

For example, in 2018, the United States imposed a 25% tariff on steel imports from China under Section 232 of the Trade Expansion Act. This sudden change caught many buyers off guard and forced them to reassess their sourcing strategies. I had to quickly adapt by diversifying my supplier base and exploring alternative sourcing destinations to mitigate the impact of these tariffs.

Moreover, different countries have varying standards and regulations for stainless steel imports. Ensuring compliance with these regulations can be challenging, especially when dealing with Chinese suppliers who may not be familiar with the specific requirements of your target market.

Market Volatility and Pricing Fluctuations

The Chinese stainless steel market6 is known for its volatility, with prices often fluctuating based on raw material costs, domestic demand, and global economic conditions. This volatility can make long-term planning challenging for international buyers.

I've experienced situations where the price of nickel, a key component in stainless steel, surged unexpectedly, leading to sudden price increases from suppliers. In one instance, I had to renegotiate a contract mid-way through a project due to these unforeseen cost increases. This experience underscored the importance of building flexibility into contracts and maintaining open communication channels with suppliers.

China offers diverse stainless steel products.True

China's stainless steel market provides a wide range of products, grades, and specifications, catering to various international needs.

Quality is consistent across all suppliers.False

Quality can vary significantly between suppliers and even between batches from the same supplier, requiring rigorous quality control measures.

What are the common challenges and pitfalls faced by buyers?

In my years of experience sourcing stainless steel from China, I've encountered numerous challenges and witnessed many buyers fall into common pitfalls. It's crucial to be aware of these issues to navigate the market successfully.

Common challenges for buyers sourcing stainless steel from China include quality inconsistencies, communication barriers, hidden costs, and delivery delays. Pitfalls often arise from inadequate supplier vetting, misunderstanding of specifications, and insufficient quality control measures.

These challenges can be daunting, but they're not insurmountable. By understanding the potential pitfalls, you can develop strategies to avoid them and ensure a smoother procurement process. Let's explore these challenges in more detail.

Quality Inconsistencies and Misrepresentation

One of the most significant challenges I've faced when sourcing stainless steel from China is dealing with quality inconsistencies. While many Chinese suppliers produce high-quality products, there are instances where the delivered goods don't meet the specified standards.

I recall a particularly frustrating experience when I ordered a batch of 316L stainless steel sheets for a client in the food processing industry. The material certificates provided by the supplier looked perfect, but when we conducted our own tests, we found that the molybdenum content was lower than specified for 316L grade. This discrepancy could have led to corrosion issues in the final product.

This incident taught me the importance of not relying solely on supplier-provided documentation. It's crucial to conduct independent testing and verification, especially for critical applications. Many buyers fall into the pitfall of assuming that a lower price doesn't compromise quality, but in reality, if a deal seems too good to be true, it often is.

Communication Barriers and Misunderstandings

Language and cultural differences can lead to significant misunderstandings in the procurement process. I've seen cases where buyers and suppliers had different interpretations of technical specifications or contract terms due to language barriers.

For instance, a colleague once ordered stainless steel tubes with a specific surface finish. The Chinese supplier confirmed the order, but when the goods arrived, the surface finish was completely different from what was expected. It turned out that the term used to describe the finish had a slightly different meaning in the Chinese context.

To avoid such pitfalls, it's crucial to be extremely clear and specific in all communications. Using visual aids, detailed technical drawings, and even video calls can help ensure that both parties have the same understanding of the requirements.

Hidden Costs and Pricing Structures

Many buyers fall into the trap of focusing solely on the quoted price without considering the total cost of procurement. Hidden costs can significantly impact the overall economics of sourcing from China.

I've encountered situations where the initial quote seemed extremely competitive, but additional charges for packaging, export documentation, or quality inspections quickly eroded the perceived cost advantage. In one case, a buyer I know had to pay substantial customs duties because they weren't aware of the specific HS code classifications for their stainless steel products.

Understanding the full pricing structure, including all potential fees and taxes, is crucial. It's also important to be aware of how raw material price fluctuations might affect your final cost. Some suppliers might use pricing formulas tied to nickel or chromium prices, which can lead to unexpected cost increases if not properly understood and managed.

Delivery Delays and Logistical Challenges

Timely delivery is critical in many industries, and delays can have cascading effects on production schedules. Unfortunately, delivery delays are a common challenge when sourcing from China.

I remember a project where a delayed shipment of stainless steel coils nearly halted production at a client's manufacturing facility. The delay was caused by a combination of factors, including production issues at the supplier's end and congestion at the port of export.

To mitigate such risks, it's essential to build buffer time into your supply chain and have contingency plans. Understanding the entire logistics process, from production to delivery, can help you identify potential bottlenecks and plan accordingly.

Quality inconsistencies are commonTrue

Many Chinese suppliers may deliver products that do not meet specified standards, emphasizing the need for independent testing.

Hidden costs are insignificantFalse

Hidden costs such as packaging, export documentation, and quality inspections can significantly impact the total procurement cost.

How to navigate price fluctuations and payment terms?

Dealing with price volatility and establishing favorable payment terms are among the most challenging aspects of sourcing stainless steel from China. Over the years, I've developed strategies that help mitigate risks while maintaining positive supplier relationships.

Effectively managing stainless steel price fluctuations requires a combination of market monitoring, contract mechanisms, and strategic timing of purchases. Optimal payment terms balance risk mitigation with competitive pricing, typically involving staged payments secured through appropriate financial instruments.

Understanding these dynamics has saved my clients thousands of dollars and prevented countless supply disruptions. Let me share the approaches that have proven most effective in real-world scenarios.

Implement Price Hedging Strategies

The volatile nature of stainless steel prices, heavily influenced by nickel and chromium markets, demands sophisticated approaches to pricing. I've found that implementing various hedging strategies can significantly reduce the impact of market fluctuations on your business.

Price hedging in the stainless steel industry involves multiple techniques that can be adapted to your specific situation. One approach I've successfully implemented is the use of formula-based pricing agreements7. These agreements link the price of stainless steel to published indices for key raw materials, particularly nickel. When the London Metal Exchange (LME) nickel price rises or falls beyond certain thresholds, the contract price adjusts accordingly.

Another effective strategy is time-phased contracting8. Rather than locking in prices for an entire year, I negotiate quarterly or semi-annual price reviews. This approach limits exposure to long-term price swings while still providing reasonable stability for planning purposes.

For larger volume requirements, I sometimes recommend direct hedging through financial instruments9. While this requires more sophisticated financial operations, it can provide significant protection against major market movements. One manufacturing client saved approximately 8% on their annual stainless steel costs by implementing a structured hedging program tied to nickel futures.

I've also found value in maintaining strategic inventory buffers during periods of anticipated price increases. When market intelligence suggests upcoming price hikes, increasing inventory levels temporarily can lock in lower prices. However, this strategy must be balanced against inventory carrying costs and cash flow considerations.

Develop Market Intelligence Networks

Making informed decisions about when to buy and how to structure contracts requires deep market insights. I've invested considerable effort in building robust market intelligence networks that provide early indicators of price movements.

My approach includes cultivating relationships with multiple suppliers across different regions of China. These connections provide ground-level insights into supply constraints, production issues, or policy changes that might affect pricing. For instance, when environmental inspections intensified in Jiangsu province in 2018, our supplier contacts alerted us weeks before the resulting production cuts drove prices upward.

I also subscribe to specialized industry reports and market analysis services focused on the stainless steel sector. These resources track not just finished steel prices but also raw material trends, production capacity changes, and international trade flows. The combination of these data sources helps identify patterns that might not be apparent from any single information channel.

Trade associations and industry conferences have proven to be valuable intelligence sources as well. At a recent stainless steel industry forum in Shanghai, discussions with industry experts revealed upcoming capacity expansions that would likely ease price pressures in the 300-series grades within six months – information that helped us time several major purchases advantageously.

Developing relationships with logistics providers has provided another valuable perspective. These companies often detect early signs of market changes through shifting shipping volumes and patterns. One freight forwarder's observation about increasing stainless steel export shipments from Tianjin port gave us an early indicator of softening domestic demand and potential price decreases.

Optimize Payment Terms and Financial Instruments

Balancing cash flow considerations with risk management requires careful structuring of payment terms. Through years of negotiation experience, I've developed approaches that protect both buyer and supplier interests.

The standard payment structure I typically negotiate includes a 30% deposit upon order confirmation, 40% upon pre-shipment inspection approval, and 30% upon receipt of shipping documents. This balanced approach provides suppliers with necessary working capital while maintaining leverage to ensure quality compliance.

For new supplier relationships, I initially use more secure payment methods like letters of credit (LC). While LCs carry higher bank fees, they provide significant protection by ensuring that payment only occurs when specified conditions are met. As the relationship develops and trust builds, we can transition to more cost-effective methods like telegraphic transfer (T/T).

I've found that offering early payment discounts can sometimes yield substantial savings. One supplier offered a 1.8% discount for payment within 10 days of shipping document receipt instead of the standard 30 days – a significant saving considering the typical margins in stainless steel trading.

For larger orders with longer production times, I negotiate payment terms tied to production milestones rather than calendar dates. This approach aligns cash outflows more closely with actual progress and provides leverage if delays occur. A recent project involving specialized surface-treated stainless steel used five payment stages tied to specific production benchmarks, improving cash flow management significantly.

Currency considerations also play an important role in payment structuring. While most Chinese suppliers prefer USD transactions, some are open to RMB payments. During periods of anticipated RMB depreciation, negotiating USD-denominated contracts can provide additional cost advantages.

| Payment Structure | Advantages | Risk Level | Best Used For |

|---|---|---|---|

| 100% T/T in Advance | Lowest pricing | Very high | Small orders with trusted suppliers |

| 30/70 T/T Split | Good pricing, some leverage | High | Repeat orders with established suppliers |

| 30/40/30 Split | Balanced approach | Medium | Standard orders with qualified suppliers |

| Letter of Credit | Strong protection | Low | New suppliers, large orders, critical items |

| Open Account (Net 30-60) | Optimal cash flow | Very high | Long-term strategic partnerships only |

Formula-based pricing reduces volatilityTrue

Formula-based pricing agreements link stainless steel prices to raw material indices, helping to mitigate market fluctuations.

100% T/T in advance is risk-freeFalse

Paying 100% in advance carries the highest risk as it provides no leverage if issues arise during production or shipment.

What logistics and shipping considerations are critical?

Mastering the logistics of importing stainless steel from China can make the difference between a smooth operation and a costly nightmare. After coordinating hundreds of shipments, I've identified the key factors that determine success in this critical area.

Effective stainless steel shipping from China requires careful selection of appropriate Incoterms, thorough packaging specifications, strategic carrier selection, and comprehensive documentation. Successful importers also implement contingency planning for delays and maintain visibility throughout the supply chain.

Let me walk you through the essential considerations that will help you avoid common pitfalls and optimize your shipping operations.

Select Appropriate Incoterms and Shipping Methods

Choosing the right Incoterms and shipping methods forms the foundation of effective logistics management. I've found that making informed decisions in these areas significantly impacts both costs and risk exposure.

Incoterms define the responsibilities, costs, and risks assumed by buyers and sellers in international transactions. For stainless steel imports from China, I typically recommend FOB (Free On Board) terms for experienced importers who want control over international shipping arrangements. This allows you to select your preferred freight forwarder and potentially negotiate better rates, especially for regular shipments.

For newer importers or those without established shipping relationships, CIF (Cost, Insurance, and Freight) terms can simplify the process, as the supplier handles arrangements to your port. However, I always ensure that insurance coverage is adequate and that the supplier isn't marking up shipping costs excessively. On one occasion, I discovered a supplier adding a 15% premium to actual shipping costs under CIF terms – switching to FOB saved my client approximately $3,800 per container.

Regarding shipping methods, ocean freight is the standard for stainless steel due to its weight and volume. For standard coils and sheets, regular dry containers (20' or 40') are typically sufficient. However, for wider materials or special requirements, open-top containers or flat racks may be necessary. I always verify the weight distribution plan, as stainless steel's density can easily exceed container weight limits if not properly calculated.

Air freight, while expensive, can be economical for small, urgent shipments of high-value specialty grades. I recently coordinated an air shipment of specialty thin-gauge 316L stainless steel when a client's production line faced shutdown – the higher shipping cost was insignificant compared to the potential production losses.

Rail freight via the China-Europe Railway Express has emerged as an interesting middle option in recent years, offering transit times about half that of ocean shipping at costs significantly lower than air freight. For shipments to European destinations, this option deserves serious consideration.

Implement Proper Packaging and Protection Measures

Appropriate packaging is crucial for preventing damage to stainless steel during transport. Through experience, sometimes painful, I've developed specific requirements that significantly reduce damage rates.

For stainless steel coils, I insist on eye-horizontal orientation with proper blocking and bracing. Each coil must be wrapped in water-resistant material, with edge protectors and anti-corrosion paper between layers. Wooden cradles designed specifically for the coil dimensions prevent movement during transit. One client reduced their damage rate from 4.7% to under 0.5% after implementing these specific packaging protocols.

For sheet products, proper palletizing is essential. I require sheets to be strapped securely to heavy-duty pallets with corner protectors, wrapped in moisture-resistant material, and clearly marked with handling instructions. The entire pallet should then be shrink-wrapped and strapped with steel bands for additional security.

Surface protection deserves special attention, particularly for decorative finishes. PVC film application protects against scratches, while VCI (Volatile Corrosion Inhibitor) paper prevents corrosion during long sea voyages. I learned this lesson the hard way when a shipment of mirror-finished sheets arrived with surface corrosion because the supplier had used standard plastic wrap instead of VCI protection.

Container loading procedures also impact product integrity. I provide specific loading diagrams to suppliers for optimal weight distribution and stability. For mixed shipments, heavier items should be placed at the bottom with proper separation between different products. Photos of the loading process, which I always request, provide valuable documentation if claims become necessary.

Seasonal considerations also affect packaging requirements. During summer months or when shipping to humid destinations, I specify additional desiccants inside the packaging to absorb moisture. For winter shipments through cold regions, additional protection against condensation is necessary when the container moves through different temperature zones.

Develop Customs Clearance Expertise

Navigating customs procedures efficiently can prevent costly delays and unexpected charges. I've developed specific approaches to streamline this often complex process.

Accurate Harmonized System (HS) code classification is fundamental to smooth customs clearance. Stainless steel products fall under various codes depending on their form, composition, and processing. I maintain a detailed reference guide for proper classification and regularly consult with customs brokers to verify changes in regulations. Misclassification can result in incorrect duty assessments or even shipment rejection – I once had to resolve a situation where incorrect HS coding led to a three-week clearance delay.

Complete and accurate documentation is essential for efficient customs processing. I prepare a comprehensive document package including commercial invoice, packing list, bill of lading, certificate of origin, mill test certificates, and any required inspection reports. Each document must contain consistent information, particularly regarding product descriptions, quantities, and values. Even minor discrepancies can trigger additional scrutiny.

For countries with anti-dumping measures against Chinese steel products, I pay particular attention to origin documentation and compliance with specific import requirements. This might include obtaining additional certifications or providing detailed manufacturing information. When importing specialized stainless steel for a client in Mexico, we needed to provide extensive documentation proving the specific grade and application to qualify for an anti-dumping duty exemption.

Pre-shipment compliance reviews have proven valuable for preventing clearance issues. Before shipping, I verify that all products meet destination country requirements, including any specific standards or certifications. For instance, some countries require specific markings or labels on steel products, while others have restrictions on certain coating compounds.

Building relationships with experienced customs brokers in destination countries provides another layer of protection. These professionals can often anticipate potential issues and recommend preventive measures. They also provide valuable guidance when regulations change, as they frequently do in the international steel trade.

| Shipping Method | Transit Time | Cost Level | Best Used For |

|---|---|---|---|

| Ocean Freight | 25-45 days | Low | Standard orders, bulk shipments |

| Air Freight | 3-7 days | Very high | Urgent, small, high-value items |

| Rail Freight | 15-22 days | Medium | European destinations, balanced time/cost |

| Express Courier | 3-5 days | Extremely high | Samples, critical small components |

| Sea-Air Combined | 14-20 days | High | Semi-urgent larger shipments |

FOB gives importers shipping controlTrue

FOB (Free On Board) terms allow importers to choose their own freight forwarder and negotiate shipping rates, giving them control over international shipping arrangements.

Air freight is always expensiveFalse

While air freight is generally more expensive, it can be economical for small, urgent shipments of high-value items where the cost of delays outweighs shipping expenses.

Conclusion

Sourcing stainless steel from China offers tremendous opportunities but requires careful navigation of potential pitfalls. By implementing thorough supplier vetting, clear communication, comprehensive quality control, and strategic relationship building, you can achieve reliable, cost-effective procurement that delivers lasting value.

-

Learn about the essential elements of purchasing steel from China, including quality and compliance factors ↩

-

Discover China's rise as a dominant force in the global stainless steel market ↩

-

Understand how raw material sourcing strengthens China's global competitiveness ↩

-

Learn about the certifications and quality standards Chinese steel often complies with ↩

-

Explore potential benefits and variety in sourcing steel from China ↩

-

Gain insights into price dynamics affecting steel procurement in China ↩

-

Learn how formula-based pricing adjusts to market fluctuations ↩

-

Understand how time-phased contracts offer flexibility ↩

-

Discover how financial instruments protect against price volatility ↩